Global Stocks Rise After US-China Deal

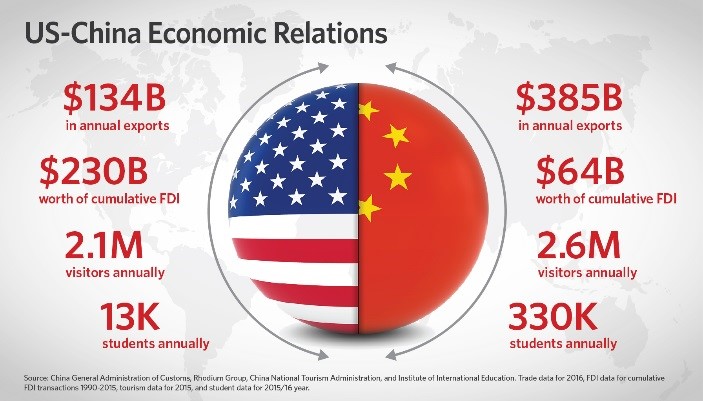

In a major move to cool long-standing trade tensions, the US-China Deal agreed to slash tariffs for a 90-day period. This temporary arrangement, widely called the “China trade deal,” sent a positive signal across global markets. Both nations plan to use this time to negotiate further agreements while offering their industries a much-needed breather.

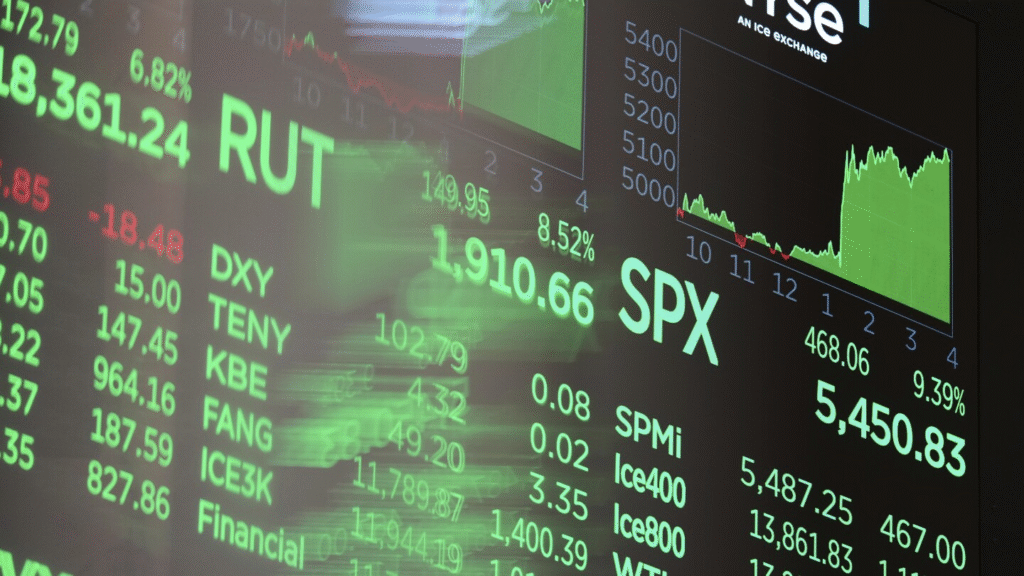

Immediate Market Reaction: Global Stocks Surge

Right after the announcement of the 90-day China trade deal, stock markets around the world jumped. Dow futures, S&P 500 futures, and DJIA futures saw an early surge. Investors viewed this tariff truce as a welcome break from years of trade war uncertainty.

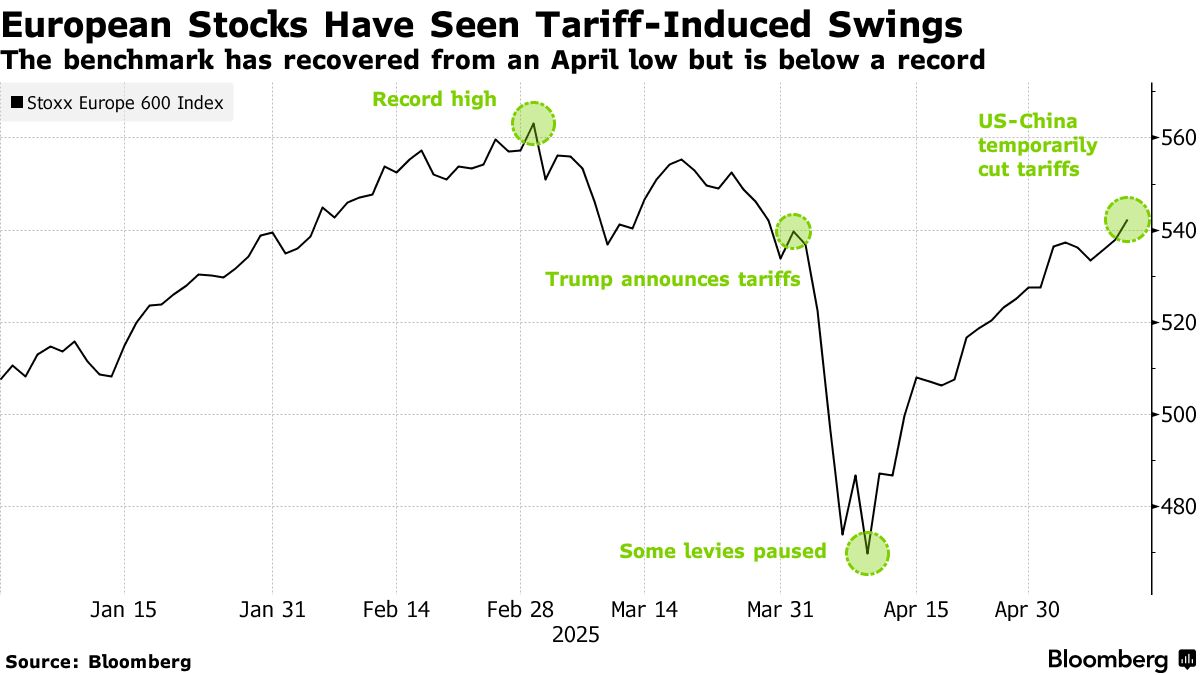

European and Asian stock indexes also rose, reflecting global relief. The Switzerland-based World Trade Organization praised the effort as a sign of cooperation returning to global economics.

Why This US-China Deal Matters Now

The timing of this US-China Deal is important. Global inflation, supply chain issues, and economic slowdowns had worried markets. The agreement to reduce tariffs – even temporarily – offers hope for stability. Businesses now expect improved cash flow, lower import costs, and steadier operations.

The tariff war between the US-China Deal had led to billions in losses and rising costs for companies and consumers. With this new agreement in place, some of those pressures may ease, even if temporarily. More importantly, it sets a precedent for dialogue rather than confrontation.

Key Details of the 90-Day Deal

- The U.S. cut tariffs on hundreds of Chinese goods, reducing some from 145% to 30%.

- China responded by lowering tariffs on American imports like soybeans, machinery, and energy products.

- The deal was reached after meetings in Switzerland, a neutral ground that facilitated peaceful talks.

- Both sides agreed to avoid imposing new tariffs during the 90-day window.

How U.S. Businesses Benefit from the US-China Deal

For U.S. manufacturers and retailers, the China trade deal means reduced costs and improved supply chains. Small businesses especially benefit, as they can import products more affordably and meet customer demand faster.

Large companies like Apple, Caterpillar, and Walmart have already expressed optimism. Lower tariffs help them keep prices competitive. U.S. automakers and agricultural exporters also expect a rebound in shipments to China, improving domestic production outlooks.

E-commerce businesses could also see advantages, as cross-border logistics become less expensive. Importers of electronic components and clothing are already planning larger shipments.

Consumer Impact: Will Prices Drop?

Yes, if the China trade deal holds, consumers may start to see price drops in the coming months. Electronics, apparel, furniture, and everyday goods could become more affordable due to lower import costs. That’s especially welcome news amid inflation concerns.

Retailers are hopeful that upcoming sales cycles will reflect these savings. As supply chains stabilize, customers may benefit from quicker delivery times and better inventory levels too.

Sector-Wide Boost: Who’s Gaining Most?

Technology: Lower component costs mean higher profits and more innovation.

Agriculture: U.S. farmers regain access to Chinese markets, especially for corn, pork, and soy.

Retail: Chains like Target and Best Buy see lower product sourcing costs.

Energy: Oil and gas companies may expand exports to China under better terms.

Manufacturing: Steel, electronics, and machinery manufacturers benefit from fewer tariffs and improved supply chains.

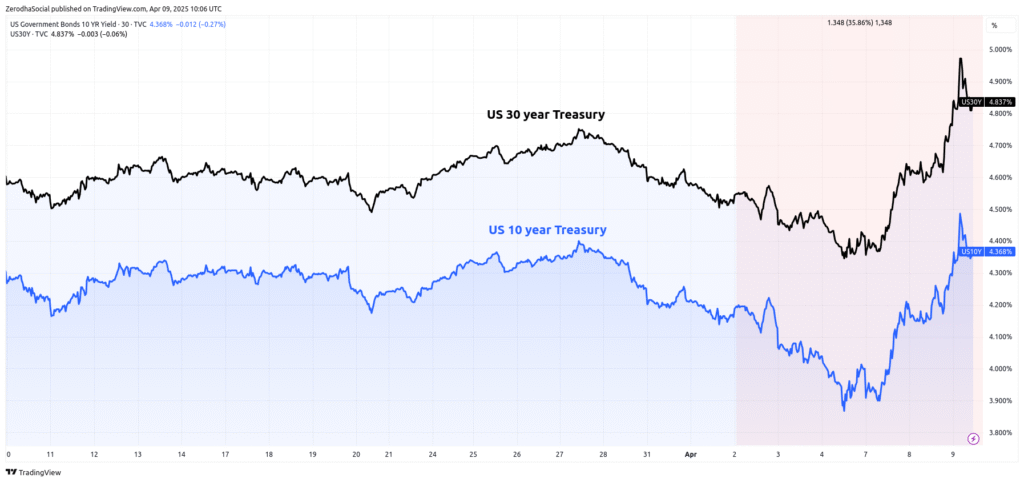

Financial Indicators Respond: Bond Yields and Currency Shifts

The China trade deal also impacted broader markets:

- The 10-year Treasury yield climbed slightly, signaling economic optimism.

- The U.S. dollar gained strength, reflecting faith in U.S. policy.

- Chinese yuan stabilized, showing confidence from both investors and governments.

- S&P 500 futures remained strong, while Nasdaq futures also showed upward momentum.

Investor confidence, which had been shaky due to prolonged trade conflicts, is now showing signs of recovery. The financial markets are cautiously optimistic.

What Experts Are Saying About the China Trade Deal

Jamieson Greer, a former U.S. Trade Representative official, noted, “This temporary deal may lead to permanent solutions.” Other analysts say this 90-day pause could be the turning point toward a long-term trade agreement.

Experts warn, however, that both sides must follow through. If talks break down or either country reimposes tariffs, markets could face renewed volatility. But for now, the deal provides breathing room and a platform for future cooperation.

What’s Next After the 90-Day US-China Deal?

While the current deal is only temporary, it opens the door for future discussions. Key topics still to be negotiated include:

- Intellectual property protections

- Digital trade regulations

- Market access for services and banking

- Climate cooperation and labor standards

The success of this 90-day US-China Deal could lay the groundwork for a permanent reset in U.S.–China trade relations.

U.S. officials have emphasized the need for fair competition and enforcement of trade rules. Meanwhile, China is pushing for equal treatment and greater market access. These negotiations will likely define global economic relations for the next decade.

Global Implications of the US-China Deal

Beyond the US-China Deal, this deal is affecting other economies. Countries like Germany, Japan, and South Korea – all heavily involved in global supply chains – have welcomed the news. Emerging markets that rely on trade stability also stand to benefit.

Stock markets in Europe and Asia gained, with investors more willing to take risks in light of reduced global tensions. Even commodity markets, such as oil and metals, showed signs of stabilization.

A Step in the Right Direction

The US-China Deal, although short-term, is already showing positive effects. Global stocks are up, inflation pressures may ease, and both American and Chinese businesses feel more confident.

While long-term concerns remain, this 90-day agreement is a rare moment of cooperation in a tense trade relationship. It proves that even limited deals can have a large impact on global markets and public sentiment.

If successful, this agreement could become the foundation for a more stable and mutually beneficial trade partnership between the world’s two largest economies.

Read more about Business and Latest News