FMCG Logistics Market Report 2025-2033: Trends, Growth Drivers, and Forecast

Market Overview

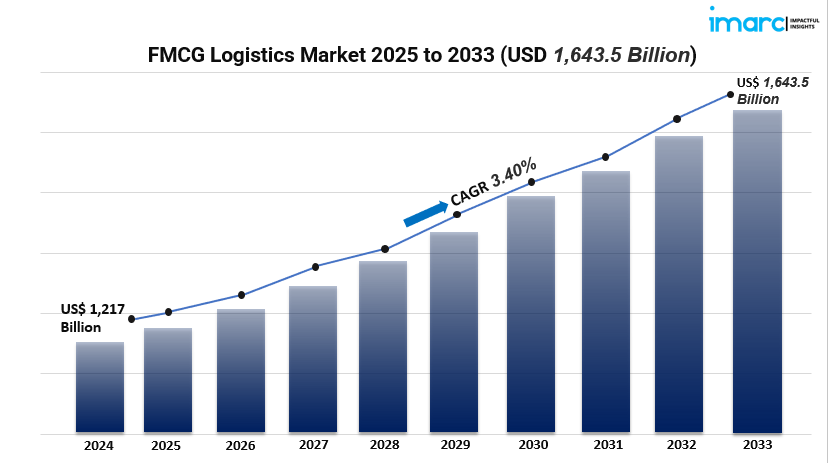

The global FMCG logistics market is witnessing robust growth, propelled by the surge in e-commerce, urbanization, and the increasing demand for efficient supply chains. In 2024, the market was valued at USD 1,217 billion and is projected to reach USD 1,643.5 billion by 2033, growing at a CAGR of 3.40% during the forecast period. Key drivers include technological advancements in logistics, such as warehouse automation and IoT-based tracking, and the expansion of cold chain logistics to support perishable goods. Asia-Pacific leads the market, accounting for over 48.9% share in 2024, driven by rapid urbanization and increasing disposable incomes.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Years: 2025-2033

FMCG Logistics Market Key Takeaways

- Market Size & Growth: Valued at USD 1,217 billion in 2024, the FMCG logistics market is expected to reach USD 1,643.5 billion by 2033, growing at a CAGR of 3.40%.

- Regional Dominance: Asia-Pacific holds over 48.9% of the market share in 2024, attributed to advancements in e-commerce infrastructure and urbanization.

- Technological Advancements: Integration of automation, IoT, and AI in logistics processes enhances efficiency and transparency.

- E-commerce Influence: The rise of e-commerce and Direct-to-Consumer (D2C) models is reshaping logistics strategies to meet consumer demands.

- Cold Chain Expansion: Growing demand for perishable goods necessitates the development of advanced cold chain logistics solutions.

- Sustainability Focus: Emphasis on green logistics practices, including the adoption of electric vehicles and energy-efficient warehouses, is gaining traction.

Market Growth Factors

1. Technological Advancements in Logistics

The FMCG logistics industry is experiencing exponential change through technology adoption, with automation, IoT, and AI-based solutions gaining traction. The technologies improve the efficiency of operations by enhancing real-time tracking, predictive analytics, and route optimization. Warehouse Management Systems (WMS) and automatic storage devices optimize inventory management, minimize errors, and enhance order fulfillment rates. The use of these technologies not only addresses the growing demand of consumers for quicker deliveries but also lowers costs of operations and improves supply chain visibility.

2. Regulatory Impact and Sustainability Initiatives

Environmental issues and regulatory compulsions are forcing FMCG players to implement sustainable logistics strategies. Electric vehicle investments, energy-efficient warehouses, and green packaging are becoming the norm. Adherence to environmental regulations not only reduces regulatory risks but also responds to the consumer desire for eco-friendly practices. Additionally, the use of blockchain technology adds transparency and supply chain traceability, enabling compliance and establishing consumer trust.

3. Rising Demand for Perishable Goods

The growing demand for perishable products, including fresh food and drinks, is accelerating the demand for sophisticated cold chain logistics. Urban lifestyles and demographics are fueling greater demand for ready-to-consume and fresh food and beverages, and with this, efficient temperature-controlled transport and storage solutions are required. Advanced cold chain infrastructure development guarantees product quality and safety, meeting the high standards of both consumers and governmental regulations.

Request for a sample copy of this report: https://www.imarcgroup.com/fmcg-logistics-market/requestsample

Market Segmentation

By Product Type

- Food and Beverage: Encompasses logistics solutions for transporting perishable and non-perishable food items, ensuring freshness and compliance with safety standards.

- Personal Care: Involves the distribution of hygiene and beauty products, requiring careful handling to maintain product integrity.

- Household Care: Covers logistics for cleaning agents and household maintenance products, focusing on efficient and safe transportation.

- Others: Includes miscellaneous FMCG products not categorized above, requiring flexible logistics solutions.

By Service Type

- Transportation: Core logistics services involving the movement of goods across various distances and modes.

- Warehousing: Storage solutions that ensure the safety and accessibility of FMCG products.

- Value Added Services: Additional services such as packaging, labeling, and quality control that enhance the value of logistics offerings.

By Mode of Transportation

- Railways: Suitable for bulk transportation over long distances, offering cost-effective solutions.

- Airways: Provides rapid delivery for high-value or time-sensitive goods.

- Roadways: Offers flexible and widespread distribution, essential for last-mile delivery.

- Waterways: Ideal for international shipping of large volumes, balancing cost and efficiency.

By Region

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Regional Insights

Asia-Pacific is the market leader in the FMCG logistics segment, commanding more than 48.9% of the market in 2024. The dominance is fueled by urbanization, rising disposable incomes, and the growth of e-commerce platforms. The nations in the region are heavily investing in developing infrastructure, improving supply chain capabilities to cater to the rising demand for FMCG goods.

Recent Developments & News

The logistics industry in FMCG is going through some major changes, with major emphasis on sustainability and technology absorption. The adoption of green logistics mechanisms, such as electric transport vehicles and energy-efficient warehouses, is being pursued by companies to minimize carbon prints. Blockchain technology integration is making the supply chain more transparent and traceable. The growth of e-commerce and D2C models is also pushing logistics companies to create more nimble and responsive supply chain solutions to accommodate changing consumer attitudes.

Key Players

- C.H. Robinson Worldwide Inc.

- CCI Logistics Ltd.

- CEVA Logistics (CMA CGM S.A.)

- DB Schenker (Deutsche Bahn AG)

- FedEx Corporation

- Hellmann Worldwide Logistics SE & Co. KG

- Kenco Group

- Kuehne + Nagel International AG

- Penske Logistics Inc. (Penske Truck Leasing Co. L.P.)

- Rhenus Group

- Simarco Worldwide Logistics Ltd

- XPO Logistics Inc.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=6445&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: +1-631-791-1145