Global Confectionery Market Outlook: In-Depth Analysis and Forecast Through 2033

Market Overview

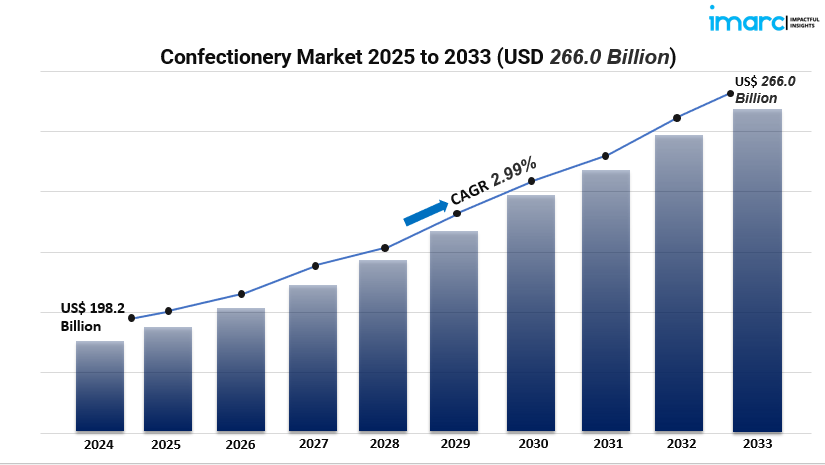

The global confectionery market is experiencing robust growth, driven by evolving consumer preferences, increased disposable incomes, and a surge in innovative product offerings. Valued at USD 198.2 billion in 2024, the market is projected to reach USD 266.0 billion by 2033, expanding at a CAGR of 2.99% during 2025–2033. Factors such as the trend of gifting confectionery items, growing urbanization, heightened focus on health and wellness, expansion of distribution channels, strategic collaborations, and investments in research and development (R&D) activities are contributing to market growth.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019–2024

- Forecast Years: 2025–2033

Confectionery Market Key Takeaways

- Market Size and Growth: The global confectionery market reached USD 198.2 billion in 2024 and is expected to grow to USD 266.0 billion by 2033, exhibiting a CAGR of 2.99% during 2025–2033.

- Product Innovation: Manufacturers are focusing on flavor and format innovations to cater to diverse consumer tastes, including sugar-free and low-calorie options.

- Premium Products Demand: There’s a rising demand for luxury and enjoyable confectionery products, contributing significantly to market growth.

- Distribution Channels: The increasing number of distribution channels, especially online platforms, is enhancing consumer choice and access.

- Regional Performance: North America leads the market, driven by consumer demand for premium and indulgent confectionery products.

Market Growth Factors

1. Technological Advancements in Product Development

The consumers’ health-oriented requirements are being met by the new technological innovations of the confectionery industry. With an eye to recent health trends, the industry is concentrating on R&D to develop sugar-free and low-calorie products. Opportunities in expanding the market are also facilitated by the increasing innovation in flavor and packaging forms that and attempt to fulfill manufacturers’ varied expectations. Additionally, the manufacture of advanced new production tools and machinery facilitates more customization and personalization, thereby enhancing the consumer experience as a whole.

2. Regulatory Impact and Health Trends

Confectionery items are increasingly affected by regulations targeting public health and wellbeing. Manufacturers are introducing new products with reduced sugar content and organic or 100% natural ingredients. Sugar-free and low-calorie products also have a strong demand that is fueling product innovation. Finally, the trend of ethical consumption is enhancing the availability of vegan and plant-based confectionery products.

3. Market Demand and Distribution Expansion

With increasing distribution channels by the marketers, particularly online, customers are gaining greater access to confectionery goods. This increased accessibility helps enhance the market by providing customers with a wider variety as well as extra convenience. Additionally, strategy partnerships and R&D investments enable the manufacturers to develop new varieties of products to meet the growing demand for high-quality and wonderful confectionery products by consumers.

Request for a sample copy of this report: https://www.imarcgroup.com/confectionery-market/requestsample

Market Segmentation

Breakup by Product Type:

- Hard-boiled Sweets: Traditional candies known for their long shelf life and variety of flavors.

- Mints: Confectioneries offering refreshing flavors, often used for breath freshening.

- Gums and Jellies: Chewy and gelatinous sweets popular among various age groups.

- Chocolate: A leading segment, encompassing a wide range of products from milk to dark chocolates.

- Caramels and Toffees: Soft and chewy sweets made by caramelizing sugar or molasses.

- Medicated Confectionery: Sweets infused with medicinal ingredients, offering health benefits.

- Fine Bakery Wares: Includes pastries and baked goods with sweet fillings or toppings.

- Others: Encompasses various other confectionery items not categorized above.

Breakup by Age Group:

- Children: Confectionery products tailored to appeal to younger consumers.

- Adult: Products designed for mature palates, often with sophisticated flavors.

- Geriatric: Sweets formulated to cater to the preferences and dietary needs of older adults.

Breakup by Price Point:

- Economy: Affordable confectionery options targeting price-sensitive consumers.

- Mid-range: Products offering a balance between quality and price.

- Luxury: Premium confectionery items with high-quality ingredients and packaging.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets: Large retail outlets offering a wide variety of confectionery products.

- Convenience Stores: Smaller retail stores providing quick access to confectionery items.

- Pharmaceutical and Drug Stores: Retailers offering medicated confectionery products.

- Online Stores: E-commerce platforms providing a broad selection of confectionery goods.

- Others: Includes various other distribution channels such as vending machines and kiosks.

Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Regional Insights

The growth in consumer demand for treat products is propelling North America’s dominance of the world confectionery market. The culture of celebration, high disposable income, and gift-giving traditions in the region drive the snacking inclination of the market. A robust economy underpins increased expenditure on confectionery products. Comprehensive retail channels, popular culture, and media influence the availability and visibility of confectionery products, which is boosted by the strong economy.

Recent Developments & News

- Nestlé’s Launch of KitKat V (August 2022): Nestle launched a vegan alternative to its signature KitKat chocolate bar to respond to the increasing need for plant-based products. The brand applies a rice-based formula in the product, which is in keeping with dietary choices like vegetarianism and veganism. This development demonstrates Nestle’s dedication to innovation and sustainability.

- Ferrero’s Acquisition of Burton’s Biscuit Company (June 202): Ferrero diversified its manufacturing capacity and footprint in the biscuit category by acquiring Burton’s Biscuit Company’s factories in the United Kingdom. This move strategically expands Ferrero’s product line and marketplace.

Key Players

Chocoladefabriken Lindt & Sprüngli AG, Crown Confectionery, Ezaki Glico Co. Ltd., Ferrero International S.A., HARIBO GmbH & Co. KG, Mars Incorporated, Meiji Holdings Co. Ltd, Mondelez International Inc., Nestle S.A., Parle Products Pvt. Ltd, The Hershey Company, The Kraft Heinz Company, etc.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=4306&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145