The Hidden Costs of College: What Families Overlook When Planning for Tuition

College is one of the most impact full investments a family will ever make—financially and emotionally. While most families focus on the price tag for tuition, the hidden costs of college are often overlooked. These unexpected expenses can quickly add up, leading to unnecessary debt, stress, and financial strain.

At College Benefits Research Group (CBRG), we guide families through the full college planning process—from selecting the right school to building a smart, sustainable college financing strategy. In this guide, we’ll unpack the lesser-known costs and provide real solutions to help families make better-informed decisions.

Understanding the True Cost of Attendance

Most families begin their search by looking at a school’s published tuition. But what many don’t realize is that tuition is only one piece of the total cost. Colleges provide an estimated cost of attendance (COA), which includes:

- Tuition and fees

- Room and board

- Books and supplies

- Transportation

- Personal expenses

However, these estimates often underrepresented reality. At CBRG, we help families calculate a more accurate, personalized COA to avoid surprise expenses later.

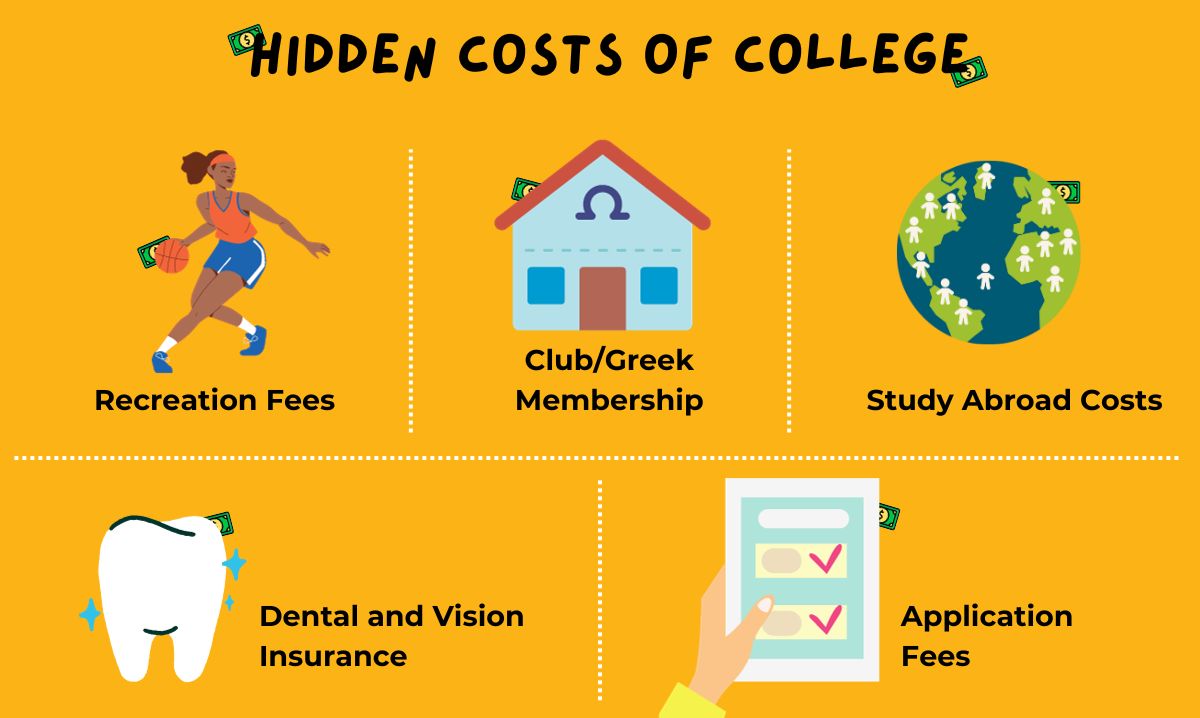

Overlooked Expenses That Add Up

Books and Academic Supplies

Depending on the major, books and required materials can cost anywhere from $600 to $1,500 per year. Courses in engineering, science, or design often require software subscriptions or lab kits not included in the sticker price.

💡 Tip: Consider book rental services and department-level grants. CBRG advisors help families identify these options early in the planning process.

Transportation and Travel

Travel isn’t just for out-of-state students. Even local students face parking permits, gas, or public transportation costs. Flying home for holidays? Those costs are rarely budgeted in advance.

💡 Tip: During our monthly webinars, we cover hidden commuting and travel costs in detail.

Room and Board Variability

The dorm your student chooses and the meal plan they’re assigned can drastically affect your bill. Living off-campus might seem cheaper, but added expenses like utilities, groceries, and furnishing an apartment can offset savings.

To explore how housing choices affect costs, download our free guide: 10 Myths About Paying for College.

Missed Financial Opportunities

Merit Aid and Scholarships

Many families think they earn too much to qualify for aid. But merit-based scholarships don’t depend on income. They’re awarded for academic achievement, leadership, or special skills.

CBRG helps students identify schools where they are more likely to receive these awards—based on test scores, GPA, extracurriculars, and program competitiveness.

Delayed Graduation

Less than 41% of students graduate in four years. Each extra semester costs more in tuition, housing, and lost income from delayed job entry.

💡 Pro Insight: One of our key services is finding the right college that aligns academically, socially, and financially—so students graduate on time.

Extra Costs Families Rarely Anticipate

Technology Requirements

Certain majors require high-performance laptops, software, or design tools. These expenses can exceed $2,000 and are usually not included in financial aid estimates.

✅ Add “required technology” to your college planning checklist—we’ll help you review each college’s hidden academic tools.

Health Insurance and Activity Fees

Most colleges require proof of health insurance. If not waived, families are automatically enrolled in school-provided coverage—which can cost upwards of $2,500 per year. Add in activity fees, lab fees, and student center access—and your bill may rise fast.

Visit our FAQ to learn which costs are waivable and which are mandatory.

Parents: Don’t Compromise Your Own Financial Security

Many parents feel emotionally obligated to cover every cost—even if it means taking out PLUS loans or withdrawing retirement savings. This short-term solution can become a long-term financial burden.

At CBRG, we help families develop smart, sustainable plans that balance college expenses with future goals. Learn more through our college planning webinars and start planning with confidence.

Make a Smarter College Choice

Choosing a college isn’t just about academics or reputation—it’s about long-term value. We help families answer tough questions like:

- What college should I go to based on career goals?

- What is the real cost vs. advertised cost?

- How do I compare schools beyond tuition?

Check out our full guide to the college application process to learn more.

Take the Next Step with College Benefits Research Group

The hidden costs of college are real—but with proper planning, they’re manageable. At College Benefits Research Group, our expert advisors help families create customized strategies to navigate the college application process, finance college smartly, and find the right college fit—all while preserving your financial well-being.

📌 Start now with these next steps:

- Explore our Resources

- Sign up for a free report

- Schedule a consultation

- Subscribe to our newsletter for regular college info and updates